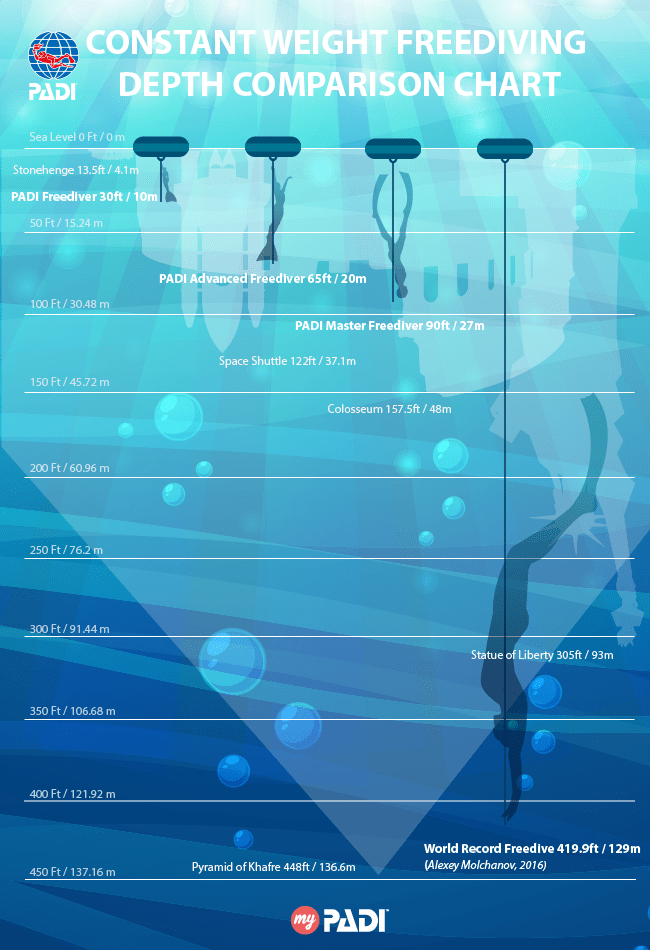

Diving Depth Chart

Diving Depth Chart - In 2025, there are notable changes in the social security tax limits that directly impact workers and their future benefits. Social security tax break 2025 gives up to $12,000 in deductions for seniors, eliminating taxes on social security income for 88% of retirees. It's likely that we could see even more social security changes as we move deeper into 2025, including a possible end to social security benefit taxes on seniors. The bill impacts the program across three critical dimensions: The new taxable income limit is set at $176,100, a substantial. Here's what actually changes in 2025. Up to 85 percent of social security benefits can be taxed—but a new deduction will reduce how much seniors need to pay. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their social security, seniors can save more of their money. It's likely that we could see even more social security changes as we move deeper into 2025, including a possible end to social security benefit taxes on seniors. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their social security, seniors can save more of their money. Here's. Up to 85 percent of social security benefits can be taxed—but a new deduction will reduce how much seniors need to pay. The new taxable income limit is set at $176,100, a substantial. In 2025, there are notable changes in the social security tax limits that directly impact workers and their future benefits. It's likely that we could see even. The new taxable income limit is set at $176,100, a substantial. Here's what actually changes in 2025. Up to 85 percent of social security benefits can be taxed—but a new deduction will reduce how much seniors need to pay. It's likely that we could see even more social security changes as we move deeper into 2025, including a possible end. Here's what actually changes in 2025. The new taxable income limit is set at $176,100, a substantial. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their social security, seniors can save more of their money. Social security tax break 2025 gives up to $12,000 in deductions for. Social security tax break 2025 gives up to $12,000 in deductions for seniors, eliminating taxes on social security income for 88% of retirees. The bill impacts the program across three critical dimensions: Here's what actually changes in 2025. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their. Social security tax break 2025 gives up to $12,000 in deductions for seniors, eliminating taxes on social security income for 88% of retirees. It's likely that we could see even more social security changes as we move deeper into 2025, including a possible end to social security benefit taxes on seniors. Here's what actually changes in 2025. In 2025, there. The new taxable income limit is set at $176,100, a substantial. Social security tax break 2025 gives up to $12,000 in deductions for seniors, eliminating taxes on social security income for 88% of retirees. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their social security, seniors can. In 2025, there are notable changes in the social security tax limits that directly impact workers and their future benefits. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their social security, seniors can save more of their money. Here's what actually changes in 2025. The new taxable. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their social security, seniors can save more of their money. In 2025, there are notable changes in the social security tax limits that directly impact workers and their future benefits. Social security tax break 2025 gives up to $12,000. The bill impacts the program across three critical dimensions: It's likely that we could see even more social security changes as we move deeper into 2025, including a possible end to social security benefit taxes on seniors. This amounts to the largest tax break in history for america’s seniors — and makes sure that after years of earning their social.Crankbait Diving Depth Chart at Emily Jenkins blog

Depth Chart For Dipsy Divers

Scuba Dive Depth Charts at Rudolph Miller blog

What Is A Depth Table at Elmer Orndorff blog

The key depths of freediving all in one cool little graphic. Thanks

What Is the Maximum Depth a Human Can Dive to

Dive Time Chart A Visual Reference of Charts Chart Master

How Deep Can You SCUBA Dive? Wetsuit Wearhouse Blog

Jet Diver Dive Chart at Roger Grooms blog

Scuba Diving Depth Chart

Related Post: